What is a Crowdsale?

A Crowdsale is a new way to use cryptocurrency technology to issue tokens that can represent shares or equity in a company. This is a powerful shift where anyone in the world can trade shares regardless of their wealth or status. For example, in the USA, you can only invest in private companies if you are an ‘Accredited Investor’, which means you are rich and you exclude the rest of the population from ownership.

Cryptocurrency Crowdsales allow an average person to build assets and have ownership, just like the rich have always done. Crowdsales are leveling the playing field and helping the lower class to acquire wealth that will help the entire human species prosper.

Isn’t it about time that we, as humans, all joined together to let everyone have prosperity? Are we that selfish that we can’t let the poor play by the same rules as the rich? Support Crowdsales as a needed change to the system and give everyone a chance to invest any small amount into any idea that they think is great.

“Power to the People, Right On!” – John Lennon

WHAT WE DO?

CROWDSALES

-

Agile Marketing

Our team is very nimble, and we can build and execute projects quickly.

-

Innovative

Every crowdsale gets fully-customized solutions.

-

Communication

Ideavirus spreading at light speed across the best social networks around.

How about Some Fun Facts about us?

Chipotle Burritos Ordered

Clients Worked With

Projects Completed

Books Published

Our Services

Our services are delivered by our team with 15 years of experience are passionate about developing business.

-

ICO Marketing

We get investors to your ICO landing pages giving you the exposure to make your token sale a huge success.

What we offer

- Affordable commission based pricing of 1% -10%

- Pay per performance based business model giving startups no upfront costs.

- Niche and mainstream advertising networks exposure

-

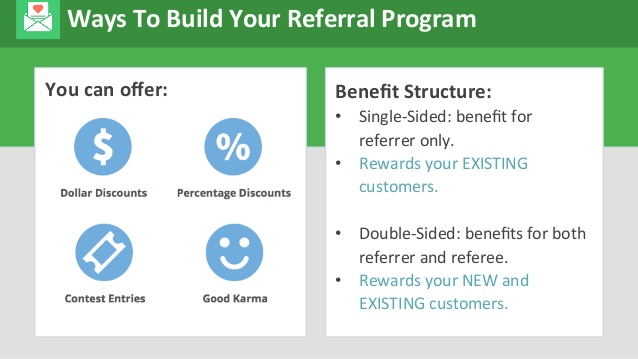

Referral Programs

Help setup a referral/affiliate style program to create a viral marketing campaign.

What we offer

- Private and public affiliate deals.

- Help with analytic setups to ensure excellent tracking.

- Proven experience in webmastering and reporting.

-

Technical ICO Consulting

Need Crowdsale advice or help with high-level strategy? Early in your development cycle and need help with setup?

Technical ICO Recommendations:

Are you ready to start a conversation?

Get in TouchContact

We'd really love to hear from you so why not drop us an email and we'll get back to you as soon as we can.

Contact email: phil -at- crowdsale.co

Crowdsale DIY

Crowdsale Ideals and Concepts of Liberty

The whole concept behind a crowdsale (or initial coin offering or ICO) is to bring investing to the common man. Traditionally, restrictions have been put on who can invest in companies that are not yet regulated and public. For example, if you are under the USA law, you have to be an ‘accredited investor’ to make these types of private deals. In other words, you have to be rich to play this game of ownership and wealth creation. A cryptocurrency crowdsale levels the playing field and gives the masses power. It allows for wealth to be distributed more fairly and not be so concentrated in the hands of the rich elite. This is why the idea behind the crowdsale is noble and virtuous. Anyone can make a small investment in a company or project and reap the same rewards that the rich do when they invest. A crowdsale allows for the barrier of entry for investing in the equity of a company to be lowered where anyone in the world can participate. This is why a crowdsale is the next generation of democratic power given back to the people.

Dictionary Crowdsale Definition

A crowdsale is the use of cryptocurrency to release an asset, like a stock equity, or software token that is required for a particular application to work. It is an entry in a distributed database that is mathematically unbreakable, electronically transferable, and potentially tradable like an equity.

The Crowdsale Token

The token is the cryptocurrency that is tied to the value of the crowdsale. So when a project is raising money, the token is the unit of measure that is used. For example, a website might want to raise money to hire web developers to update the site and issue a ‘revenue share’ token, where a percentage of the website earnings is paid out to the token holder, just as a private company would pay out a bonus based on company earnings.

Types of Crowdsale Tokens

Revenue Share Token

This type of token is linked to a known revenue stream, wherein the token holder will get a percentage of the revenue based on how many tokens he has. A good example for this is a website that has advertising revenue. Let’s stay the website makes $10,000 a month from Google Adsense. The site could try and raise money through a crowdsale by setting a fixed percentage that is paid out to each month. The pitch a website must make to raise money is that they will ‘upgrade the site’, ‘add new functionality’, etc. As you can imagine, the numbers on this have to make sense so that investors can make a reasonable profit for the risk they are looking at.

Software Access Token

This type is a piece of the software or technology used to make it function. The concept here is that the software is used to do something valuable and they, the investor, would have to use this currency. A good example for this would be a mobile poker app that only allows players to use ‘their’ currency. You are required to have this token to play poker. There are many other uses for this type where the token doesn’t have to be a direct currency and could be more like a subscription to a service or product.

Pegged Tokens

These are tokens that are pegged to some real (or imagined) physical good or service. The point of these tokens is to make it easy for someone to trade these real world items electronically. The advantages of this are vast, as the idea of sending gold or any other physical product around is expensive. If, in the other hand, you could just trade someone a token pegged to a commodity, then you have an incredibly efficient system. The problem is that you need to be able to redeem the token for the item it represents, so the actual implementation of pegged tokens can be very difficult. An example of a pegged token is one that is worth the cost of $1 USD. So 1 token = $1 USD. You could easily peg it to an ounce of gold, a pound of goat hair, etc., but what’s more exciting is pegging it to concepts like carbon credits, ecological projects, or intellectual thoughts and ideas.

Hybrid Cryptocurrency Token

There are a number of other ways to think about what a token represents and why someone would want it. For example, you could use a few of these styles to make a token that has a revenue stream and is pegged to a certain price. This way, your crowdsale might tap into a few different buyer markets and attract investors that are looking for income, and the safety of being attached at the hip to something they can touch, feel or just believe in.

Crowdsale Objectives and Goals

The objectives everyone should be interested in is how much money can you raise. The goal of every crowdsale is to raise as much money as possible. Sure, every project has an amount that would make them happy, but not one project has turned away more money. If you can raise it, then you will keep it, period.

The crowdsale acts as two things:

- To raise money

- To raise awareness

This second feature is massively powerful in getting a large audience that can consume your product, or advocate it. The real objective of a crowdsale is to get a lot of people in investing a lot of money in the project. That way, you’ve created an army of people that have ‘skin in the game’. These people are investors, and so they have a vested interest in the project succeeding. Basically, you’ve just created a huge audience that will spread the word for free because they want to profit, and because they don’t want to look like an idiot for investing in a dog.

DIY Crowdsale

You can totally do a crowdsale yourself these days. Here are the recommended steps you need to take to have a successful one.

Product Pitch Deck

This is a document or presentation that describes your product or service. It is important to first have a content that explains what you have. Building this will really help you figure out what you exactly have. Without this, you don’t have the foundation to even start to think about a crowdsale. Remember: a cryptocurrency crowdsale is just a way to raise money or give access to a token in your network. You really need to have solid information about what you’re offering.

Simply, this is a document or presentation that says everything about why someone should trust in you and your product to invest. Complexly, this is your unique value proposition and will act as your roadmap for what you token is.

Crowdsale Pitch Deck

This can be part of your Product Pitch Deck later, but first, think about this as a separate function. The objective here is to create something that talks about the value proposition of the actual crowdsale. You need to know the mechanics of the crowdsale to explain all the economics and metrics that matter. The deck is also a trust building exercise, as you really need to be transparent and honest with your intentions, else no one will buy it.

A Crowdsale Weary Community

Make no mistakes that there have been TONS of crowdsale scams. Some scams have even been very long drawn-out manipulations, with many complex and elaborate schemes. This is why the crypto community is very gun-shy about investing in just any old crowdsale. You really need to be sincere and transparent about the projects goals and actors. I recommend that projects be 100% open about the makeup of the executive team and their histories. You really have just one shot to gain the trust of investors, otherwise, the community will hunt you down.

Crowdsale Funding Transparency

One of the most important things to do is to give 100% full transparency to the cryptocurrency you are raising. This is typically called Proof of Reserve and is the ultimate way to show your investors that you have the money you say you have. The simplest way to showcase this is to have one Bitcoin address that everyone makes a payment to. That way, all investors can see the balance and know that it will be traceable from the original address. An even better way is to use a multisignature transaction with a 3rd party or trusted node. This way, the investor has peace of mind that this isn’t a scam and you will be open with your financials. A great feature of cryptocurrency is that you can be more transparent with your numbers, take full advantage of this and make sure to show your investors the metrics they want to see. These metrics are going to be: 1. How much you raised? 2. How many tokens were sold?

Crowdsale Economics

Understanding the economics of a crowdsale is extremely important. Each crowdsale is totally different, depending on many factors. These factors include token creation rate, premine amount, coin amount given to founders, etc…

Understanding Token Creation Rate

This is an extremely important concept. You need to know how many tokens are going to be created in total and what the rate of distribution is. For example, currently every 10 minutes, 25 Bitcoin are created. So that equals to 3600 Bitcoin created every day. If your token is going to be mined or have a distribution over time, you need to think about the impact it will have to the value. Will the market be able to sustain the amount of token creation per day? Then think about how that distribution will work. Do you give early miners more tokens and then reduce the amount over time like Bitcoin? What about the opposite creation rate? What about a creation rate that varies by the amount of transactions on the network? As you can imagine, there are tons of different token creation rates that have been tried because it affects the interest in the token and the economics.

Premine Amount and Release Schedule

This is the amount that the developer of the coin will have ownership over. It can be a fixed amount that is given at the beginning of the token creation process, or can be released to the developers over time. For example, there can even be a lockup period where the developers don’t get them until after one year from release. It is very valuable to know how much the founders are taking and if they can create more. If the developers can create more tokens (token’s out of thin air), then they can really make the economics unfavorable to the crowdsale investors.

Crowdsale Length

- Typically, you want to have it be between 7 – 60 days. One week would be for something really hot, and you could capture a large amount of people who are willing to spend money. Up to 60 days for projects that need more time to attract different groups of people. Typically, this works good for an in-person roadshow, where the management can shop around different angel investor clubs without running out of time. Anything beyond 60 days and you risk people forgetting about you and moving on. You need to carry momentum because the Bitcoin space is moving very fast and it’s really hard to keep people’s attention for that long without a massive budget.

Early Investor Rewards

- Many times, it makes sense to have a crowdsale give out a bigger portion at the beginning then be reduced over time to the deadline. The advantage is that you will get the party started, and so when people see that there is already investment money coming in, they will want to invest. You really want to tap into people’s greed to make that bonus structure seem like it is now or never. Your goal is to get people to act immediately, as the fear of missing out will seemingly give them more pain if they wait. Be careful of the curve of your pricing. For example, if you give out 500 per unit at the beginning and 100 at the end, this 5 times fold will greatly reduce the amount of sales you get at the end. People will see that others got it 5 times cheaper and will resent your project.

Bitcoin Community Perception of Token Creation

The crypto community will turn on you in an instant if you try and cheat and steal. It is very important to get all the details right or they will pick you apart on the bitcointalks of the world. The last people you want to piss off are the investors. If you do this, then your chances of success are very bad. This community is hypercritical and has a lot of shills and haters that will bash your product no matter what. Don’t give anyone any fuel to make these claims valid against you.

Executing the Crowdsale

Once you decide about the crowdsale economics and other details, then you need to pick the platform you want to raise money in. There are no rules about picking just one platform as well, you can raise money across multiple currencies then combine them into one.

Why Crowdsale across multiple Cryptocurrencies

You might choose to use multiple platforms to increase the amount of money and awareness. This makes sense if you have something unique that a certain platform would want. For example, you might choose NXT if your token will specifically benefit that network with the feature or functionality it has. So if it makes sense to tap into multiple platforms with a unique spin for each of them and how they will benefit, then go for it. If you are just using it as a fundraising gimmick, then think twice as you will be sniffed out and haters will attempt to destroy you even more than normal.

Crowdsale Platforms

Picking the right platform for your crowdsale can be the key to getting the right audience of investors to take notice. You really need to check out each of these and get to know what the community is like. Each is pretty different and will be a big factor in your success.

Mastercoin (now Omni)

Mastercoin was the first Bitcoin 2.0 engine to launch your own token on. It has the advantage of being around the longest and led by some really smart people. The problem is the market cap— it’s really low for MSC (Mastercoin the crypto), so you’ll have to raise in Bitcoin and so that doesn’t do a ton of the MSC community…unless they peg MSC to Bitcoin, which they did and it failed. Projects like Maidsafe, Tether, and Agoras Tokens are on the new Omni.

Counterparty

The real problem with them is they only have a webclient. Your wallet is on an ICANN domain name of counterparty.co, so if this domain goes down due to a DDOS attack, crappy host or registrar, SQL injection hack, etc., then you’re in trouble. The best platforms have a local client that can be run to decentralize and distribute the load. This way, there is no ICANN regulated website to get hacked or turned off by some government or corporation.

Bitshares

This platform has a bit following in a larger market cap, but the pricing is keeping folks away. They want thousands of dollar to list your token. This is too expensive for the average person, and why should even a big company reserve a name for that price. It’s truly creating something out of nothing, so they have a long way to go to have so much value that the thousands of USD makes sense.

NXT

This is a great engine, as they have a slick client application and an active development team. The market cap isn’t that great and can make it hard for real big crowdsales, but the community is very active and really has great tools. Regardless if you hate the controversial distribution of NXT tokens, you should look at the technology from a pure product standpoint and see how mature it is compared to other offerings.

Ethereum

The darling of an eccentric genus, this platform is the choice of many new assets as has the network effect of having lots of people and money involved. Projects like Golem, Augur, Gnosis, Round and many others are based on this token.

Waves

Bankcoin and Incent are the big projects on Waves that are looking strong.

Crowdsale Viral Marketing Tactics

The objective of these tactics is to raise as much money on the ICO for the least amount of cost. This limits the risk on the project and gets the most bang for the buck.

Refer a Friend Program

A referral program that incentivize BOTH the friend and referrer is ideal as it creates a role for each and a mechanism to turn investors into paid advocates. For example, the friend gets a 10% bonus and the referrer also gets a 10% bonus.

The easiest way to do this is to use a unique url for each user.

1. Investor signs up with email/password and system assigns a unique url. (ie icosite.io/r/dj189dh13)

2. Investor then can post that unique url on social media and email friends the link to get the 10% credit.

(marketing copy example) “Both you and your friend get a 10% bonus on this ICO.”

3. All unique urls have the same landing page and redirect from icosite.io/r/dj189dh13 to icosite.io/ico

4. Referral is tracked as Goals in Google Analytics or other solutions where data is merged between web referrer traffic and internal ICO sales database.

5. Friend gets 10% bonus when buying in the form of a coupon code or other tracking mechanism, referrer gets 10% bonus paid after the sale is complete.

This is the same model that made some mainstream sites massive and is perfect for the network effect peer to peer nature of cryptocurrency projects. For example, Airbnb offers a $35 bonus to the friend and a $40 bonus to the referrer, Also Uber, Lyft offer similar offerings that reward both parties with credits inside the system. Done right, this is the cheapest and most effective way to turn your investors into an army of promoters.

Simple Web Based Tracking System:

A lot of ICOs are working with 3rd parties and other custom solutions for the actual token creation and accepting payments from Bitcoin, ETH and others. When this is the case, you have to merge your web data with the sales data from the 3rd party, as most likely your ICO landing page is going to be hosted on www.NotYourDomainName.org…and you won’t have web analytics data. Otherwise, if you are doing it yourself you can setup your tracking like this…

Front End (html) Components Needed:

1. Investor Account Registration Page (ie icoxzy.io/reg)

– simple html signup page where user enters email/password

– user is assigned a uniqueID (this is random number for referral url creation)

2. Dashboard Page (ie icoxzy.io/dash)

– displays investors email, update password interface, refer a friend url.

– refer a friend url (ie icosite.io/r/dj189dh13)

3. ICO Buying Page (ie icoxzy.io/ICO)

– displays exchange rate (ie how many ICOCoins for each Bitcoin,ETH,etc..)

– contains payment system (can be 3rd party system)

– Logic: if page referrer contains any refer a friend url (ie /r/dj189dh13), then give 10% discount when buying) *Conversely you can give a 10% discount at the end with the referrer bonus.

Web Analytics Tracking:

Using google analytics (GA), we can track all the uniqueID url usage.

1. Put GA general tracking codes on all pages.

2. Setup GA Goal and put tracking pixel code on payment confirmation page (might be on 3rd party, have to contact them).

-track payment amount for each uniqueID (in btc,eth,etc…)

Figuring Out Payouts:

Easiest way to do a refer a friend bonus like this is to do a % increase (ie 10%), but other more elaborate ways to do bonuses exist. For this simple example, now all you have to do extract your Google Analytics data into a spreadsheet and calculate the 10% bonus for all the referrers, as you have the investor Payment Amount and each uniqueID that is assigned to an email address.

Crypto Crowdsale Tips Beyond The Sale

1. Customer Growth

Next step is to grow your customer/user base. The more eyeballs the better, of course acquiring paying customers is the ultimate goal, but hooking users to your blockchain is the top priority after ICO. There are going to be so many competing blockchains that your project needs to stand out from the rest. Even just collecting email addresses can be a good start to building your userbase. Remember that users are also investors, so you have to keep them interested in your project and show growth…or at least tell a good story. Study how equity prices can levitate when investors believe in the story. For example, look at how Tesla and Amazon can lose money every quarter but the stock price keeps going up. These companies have charmed their investors into believing a narrative, this is exactly what you need to do!

2. National Fiat Currency to Crypto

The easiest way to grow your userbase is to find ways to convert fiat currencies, ie(united states dollars) into your cryptocurrency. This is the best way to grow because their is an almost unlimited amount of printed national fiat currencies available worldwide. If your cryptocoin is only traded against Bitcoin then there is a fairly finite amount of money that can actually be invested into it.

3. Always Keeping Investors Involved

From the very beginning investors need to be coddled and handheld to keep believing in you and eventually turned into advocates that will refer their friends and defend against attacks. Competing projects will denounce and smear you, calling your chain a scam. Investors will hear their scam claims and start to question. Always over communicate with your investors as you want to keep them in the loop and coming to you for information, not letting their imagination run wild from the rumor mills. Most importantly, communicate consistently, this is a marathon not a sprint, and requires ongoing attention to detail. Keep your finger on the pulse of the industry and your project and you’ll know the appropriate response for the ‘sign of the times’.

4. Finger on the Pulse of Crypto

The cryptocurrency space is very moody, it can be a hippie commune singing kumbaya one day with everyone helping and happy for the success of the community…and the next day be a hellhole of hate pointing blame at some faction within the community or mass media magnifies some story about how crypto is ‘killing the children’. You need to really understand what the vibe of the times is and how you can keep your investors calm on negative days, and crank them up to 11 on the ‘to the moon’ days.

Latest Ideas

Here are our thoughts about the cryptocurrency ICO space.

Hey Everybody, Crowdsale (Phil Maher) is back!

17 Feb 0 CommentsFirst of all, thanks to everyone I’ve worked with since

Brand Protection Marketing Specialist

17 Feb 0 CommentsIntroduction My expertise is derived from 20 years of experience

5 Tips for ICO Marketing and Promotion

29 Aug 0 CommentsHere are the top 5 tips for promoting your ICO

Why ICO Bounty Programs Aren’t Everything

09 Aug 0 CommentsFolks be scamming the bounty programs, for example, everytime I

Why Cryptocurrency Airdrops like BCH Dreadfully Misallocate Capital

02 Aug 0 CommentsBCH (also known as bcash) is the new cryptocurrency created

Excited to know more about us?

Contact us